Large gap with delayed quotes

|

Last quote

03/20/2024 -

10:25:52

|

Bid

12/20/2024 -

16:43:32

|

Bid Volume |

Ask

12/20/2024 -

16:43:32

|

Ask Volume |

|---|---|---|---|---|

|

101.22 %

+1.35

(

+1.35% )

|

105.16

%

|

500,000 |

105.66

%

|

500,000 |

Essential data

|

Underlying quote

Last quote

|

Strike (distance %)

Product category

|

|---|---|

|

19,884.75

-85.11

(

-0.43% )

12/20/2024 17:50:00 |

-

EUR (%)

9.15% (6.10% p.a.) ZKB Reverse Convertible Defensive on worst of SMI Index / DAX Index / S&P 500 Index

|

| Prospectus | de |

Master data de

| Issuer | Zuercher Kantonalbank Finance (Guernsey) LTD |

|---|---|

| Product | 9.15 BSKT/ZKBG 25 |

| Domicile | GG |

| Issue Date | - |

| Maturity Date | 03/04/2025 |

| Last Listing Date | 02/25/2025 |

| Issue Volume | - |

| Issue Price | 100.00 |

| Instr. Unit | Nominal (par value/face value) |

| Denomination | 1,000.00 |

| CCY | EUR |

| ISIN | CH1273457544 |

| Valor | 127345754 |

| Symbol | Z23CDZ |

| Call by Holder | No |

| Call by Issuer | No |

Important data

| Strike | - |

|---|---|

| Ratio | |

| Instrument type | Structured instruments |

Main data

| Last | - | 10:25:52 | +101.22% |

|---|---|---|---|

| Close | - | 03/20/2024 | +101.22% |

| Day Change % | - | - | +1.35% |

| Day Change | - | - | +1.35 |

| Volume | - | - | - |

| Turnover | - | - | 708,540.00 |

| Previous year close | - | 12/29/2023 | +101.97% |

| YTD % | - | - | -0.74% |

Eusipa coding

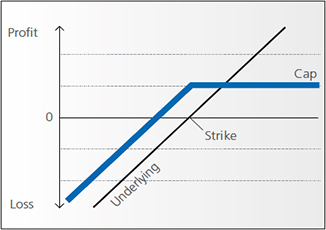

| Eusipa Category | Yield Enhancement |

|---|---|

| EUSIPA Class | Reverse Convertible (1220) |

| Product Class | 9.15% (6.10% p.a.) ZKB Reverse Convertible Defensive on worst of SMI Index / DAX Index / S&P 500 Index |

|

|

Difference trading

| Open | - | - | - |

|---|---|---|---|

| Bid | - | 16:43:32 | +105.16% |

| Bid Size | - | - | 500,000 |

| Ask | - | 16:43:32 | +105.66% |

| Ask Size | - | - | 500,000 |

Difference price

| Previous Day High | 101.22 % |

|---|---|

| Previous Day Low | 101.22 % |

Interest payment

| Interest Date | 03/03/2024 |

|---|---|

| Interest | 6.10% |

| Daycount Convention | 30/360 |