Large gap with delayed quotes

|

Last quote

06/27/2025

-

17:09:31

|

Bid

07/04/2025 -

12:18:38

|

Bid Volume |

Ask

07/04/2025 -

12:18:38

|

Ask Volume |

|---|---|---|---|---|

|

0.315

-0.09

(

-22.22% )

|

0.315

|

500,000 |

0.325

|

500,000 |

Master data

| Issuer | Bank Vontobel AG |

|---|---|

| Product | DAX/VONT PW 12.25 |

| Domicile | CH |

| Issue Date | - |

| Maturity Date | 12/19/2025 |

| Last Listing Date | 12/19/2025 |

| Issue Volume | 50,000,000 |

| Issue Price | 2.04 |

| Instr. Unit | Piece/unit |

| CCY | CHF |

| ISIN | CH1374344880 |

| Valor | 137434488 |

| Symbol | WDAK2V |

| Call by Holder | No |

| Call by Issuer | No |

Important data

| Strike | 19,200.00 EUR |

|---|---|

| Ratio | 500:1 |

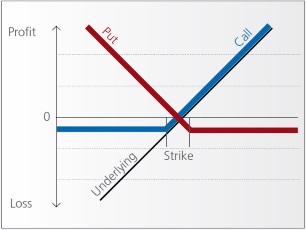

| Instrument type | Leveraged products |

| Type | Put |

| Intrinsic Value | 0.00 |

| Implied Vol | +25.04% |

| Moneyness | -24.19422 |

| Gear | 139.25426 |

| Delta | -0.08574 |

| Gamma | 0.00004 |

| Vega | 0.04735 |

| Omega | 11.94028 |

| Rho | -0.01906 |

| Theta | -0.0035 |

| Break Even | 19,028.76437 |

Main data

| Last | - | 17:09:31 | 0.315 |

|---|---|---|---|

| Close | - | 06/27/2025 | 0.315 |

| Day Change % | - | - | -22.22% |

| Day Change | - | - | -0.09 |

| Volume | - | - | - |

| Turnover | - | - | 63,000.00 |

| Previous year close | - | 12/30/2024 | 1.57 |

| YTD % | - | - | -79.94% |

Eusipa coding

| Eusipa Category | Leverage without Knock-Out |

|---|---|

| EUSIPA Class | Warrant (2100) |

| Product Class | Put Warrant auf DAX |

|

|

Difference trading

| Open | - | - | - |

|---|---|---|---|

| Bid | - | 12:18:38 | 0.315 |

| Bid Size | - | - | 500,000 |

| Ask | - | 12:18:38 | 0.325 |

| Ask Size | - | - | 500,000 |

Difference price

| Previous Day High | 0.315 |

|---|---|

| Previous Day Low | 0.315 |